Snapshot: Dufry Q3 and YTD results • Accelerating Q3 organic revenue growth of +4.1% Source: The Moodie Davitt Report |

INTERNATIONAL. Accelerating Q3 organic growth helped Dufry to report a +1.8% increase in nine-month turnover year-on-year to CHF6,682.0 million (US$6.75 billion).

The figures, released this morning, were buoyed by a solid rise in organic growth for the year to date (+2.9%), to which like-for-like growth contributed +0.1%, showing a major improvement versus the past quarters and turning positive.

Net new concessions added +2.8%. The translational foreign exchange effect in the period was -1.1% as a net effect of the strengthening of the US Dollar and weakening of the Euro and British Pound.

In the third quarter, organic growth accelerated to +4.1%. Like-for-like performance in the third quarter of 2019 continued to improve compared to the second quarter, reached +1.3%, and took like-for-like performance for the nine months into positive territory.

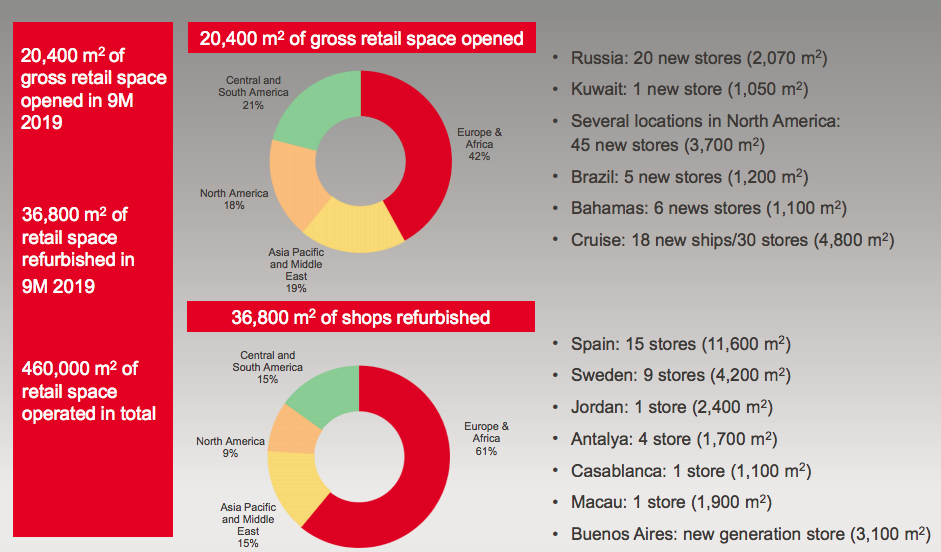

In the first nine months of 2019, the company opened and expanded 20,400sq m of gross retail space, including 20 stores in Russia, 45 shops in North America, 11 in Latin America and 30 on 18 ships.

Contracts for opening a further 14,600sq m in 2019/20 are already signed, including at Mexico City International airport for three additional shops covering 1,400sq m. Dufry also refurbished 36,800sq m of retail space – including operations in Spain, Sweden, Jordan, Argentina, Macau, Morocco and Turkey.

CEO Julián Díaz commented: “Organic growth has continued to accelerate in the third quarter, reaching +4.1%. Organic growth has been benefiting from solid contributions from new concessions and also like-for-like growth, which has been improving since the last quarter and now, during the holiday season, has reached +1.3% in the third quarter 2019.

Snapshot: Key developments post-Q3 • Agreement with AENA to extend Dufry’s duty free concession at 25 Spanish airports for up to five years. Source: The Moodie Davitt Report |

“The continuous improvements in the first nine months of 2019, where we reached an organic growth of +2.9%, clearly show that we are on the right track to achieve our targets. Excluding South America organic growth for the nine months amounted to +5.4%. These achievements are the result of focused commercial initiatives we have launched in several markets.

“In terms of divisions, Asia Pacific and Middle East continued to deliver a strong performance, including a healthy like-for-like growth. In Europe, Spain has accelerated performance, while North America has continued with its resilient growth, despite the impact from the duty free business.

“In South America, although the situation remains challenging, we saw some signs of improvement supported by an acceleration of the performance with a pickup of like-for-like sales and by softer comparable.

“We also successfully extended existing contracts, among them, our contract in Spain with AENA. I am very pleased with the renewal of this long-term partnership for up to five years and with a minimum guarantee (MAG) containing a lower annual increase than before, now amounting to +1.56%.

“Spain has improved its performance to above the agreed annual MAG increase and I am looking forward to rolling out to further locations our successful commercial initiatives and best practices already tested across five pilot airports, and for which no significant CAPEX investment will be needed.”

Commenting on Brazil, he said: “During October, the Brazilian government announced the long expected duty free allowance increase, which will double to US$1,000 and will become effective in January 2020. This is a considerable improvement as we will be able to extend and increase our product assortment in the country, offering higher priced products in the range of US$500 to US$1,000 and also increase the potential spent per ticket up to US$1,000.”

Dufry has also received regulatory approvals for the acquisition of the 60% stake of RegStaer Vnukovo announced in June and the closing of this transaction is expected to be completed in the coming days.

Díaz said: “Through this acquisition we further consolidate our position in Russia, especially in Moscow, where we will be able to extract further synergies with the integration of operations at Sheremetyevo and Domodedovo airports. The newly acquired business is fully consolidated as of November 2019.

“The acquisition of the 34 Brookstone stores by Hudson, including the exclusive right to further expand the brand in US airport retail further supports the duty paid business in the USA and shows that there are still additional growth opportunities also in mature markets.

“With the acquisition of OHM Concession Group LLC by Hudson we are adding new F&B concession capabilities, which will allow not only to increase and expand our footprint in North America, but most important to accelerate further expansion in the important North American food & beverage airport concession market.”

“We remain committed to further develop our growth strategy, which includes small and mid-size acquisitions as well as organic growth with a strong customer focus and to further accelerate it in the coming quarters. We also continue to leverage our business model to generate efficiencies, and to further accelerate the implementation of the digital strategy. We confirm our mid-term organic growth guidance of +3%-4% as well as the expected mid-term range of CHF350-400 million for Equity Free Cash Flow generation.”

Turnover by region: Europe and Africa

Turnover in the region was CHF2,932.9 million in the first nine months, with organic growth reaching +5.3% in the period. In the third quarter, organic growth accelerated to +7.2% driven by a healthy like-for-like performance.

In the UK, performance remained positive, noted Dufry. In Spain, sales continued to improve during the holiday season supported by new commercial initiatives and best practice pilots across five Spanish airports. Turkey continued to deliver solid growth and Greece posted a good performance. Finland, Italy and Malta reported positive growth as well as Africa, in particular, Morocco, Kenya and Egypt.

In addition, as reported Dufry has come to an agreement with AENA to extend its current contract in Spain to operate duty-free shops at 25 Spanish airports for up to five years, starting in November 2020.

Asia Pacific and Middle East

Turnover increased to CHF957.3 million in the first nine months with organic growth in the division reaching +13.4% mainly from the contribution of new concessions in the first nine months of 2019. Organic growth for the third quarter was also positive, reaching +12.5%, with the support of both new concessions and an improved like-for-like performance.

Performance in Eastern Europe was positive, with Russia and Serbia posting good growth. Asia Pacific continued with a double-digit growth performance, led by the opening of the Hong Kong MTR high-speed railway station as well as strong performances in Macau and China. Performance in Australia remained solid at double digit levels, supported by the start of operations at Perth.

As reported, Dufry has received all regulatory approvals for the acquisition of a majority stake of 60% in RegStaer Vnukovo and the closing of this transaction is expected to be completed in the coming days. The Vnukovo operation shall be fully consolidated as of November 2019.

North America

Turnover increased to CHF 1,469.8 million with organic growth of +2.1% in the period supported by the “resilient” performance of the duty paid business, while the duty free segment was negatively influenced by the lower spending from Chinese passengers. This impacted mainly the Canadian duty free operations and further accentuated in the third quarter, where organic growth stood at -0.6%.

Hudson struck an agreement to acquire 34 Brookstone shops across several airports in the US including the exclusive right to sell select Brookstone merchandise in Hudson shops, and to further expand the brand in the airport channel.

Hudson also acquired OHM Concession Group LLC adding new food & beverage concession capabilities, thus expanding its footprint in the world’s biggest airport F&B market. The acquisition will add approximately 60 additional food & beverage units to the existing 50 currently operated by Hudson. OHM Concession Group generated sales of US$62 million in FY 2018. Closing of the transaction is expected in Q4 2019 or Q1 2020.

Central and South America

Turnover was CHF 1,137.6 million in the first nine months, with organic growth falling -8.4%. Performance in the third quarter was -3.8% supported the implementation of commercial initiatives and by better comparables, said Dufry. In South America, the situation remains challenging with most operations still impacted by the devaluation of local currencies, especially in Brazil and Argentina.

Performance in the Caribbean was good with the cruise business continuing to post a positive contribution. Performance in Mexico and Dominican Republic was also positive.

In Brazil, Dufry has inaugurated its first border shop in the city of Uruguaiana in August. Dufry said it “continues to closely monitor the performance of this new retail format and adapting the product assortment to best match local demand. The border duty free shop channel in Brazil holds considerable potential as it can be expanded into other 32 cities across the country.”